In the United States, there are a total of fortyfive states (including the District of Columbia) that apply general sales taxes to all goods within the state as well as certain services.

Out of these, there are thirty-seven states, Oklahoma included, that allow general sales taxes at a local, or city level.

There are five states that carry the highest average local sales tax rates. Oklahoma is one of these states, with an average local sales tax rate of 4.45 percent. There are also a total of 356 local tax jurisdictions across the state, collecting an average local tax of 3.193 percent.

Other states carrying the highest average include Alabama (5.22 percent), Louisiana (5.07 percent), Colorado (4.75 percent), and New York (4.52 percent).

Like nearly all states within the nation, state and local economies were strongly, and negatively, impacted by the COVID-19 pandemic in 2020.

Throughout 2021, however, revenues within local entities have increased, though there are some that have seen a decrease, varying from month to month.

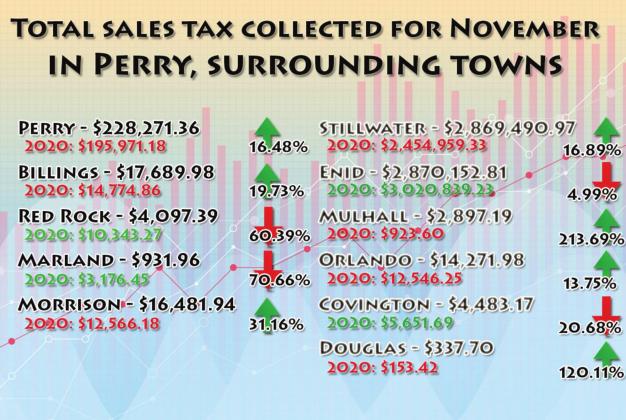

The city of Billings November 2021 revenues increased 19.73% compared to November 2020 and Red Rock reached a 60.39% decrease, Marland a 70.66% decrease, and Morrison a 31.16% increase.

Compared to November 2020, Mulhall’s increase in revenues was whopping 213.69% and Orlando’s was a 13.75% increase.

The community of Douglas showed a 120.11% increase while Covington exemplified a 20.68% decrease.

Stillwater portrayed a 16.89% increase while Enid exhibited a 4.99% decrease.

The City of Perry’s November 2021 sales tax revenues saw an increase of 16.48%, from $195,971.18 in November 2020 to $228,271.36 in November of this year.